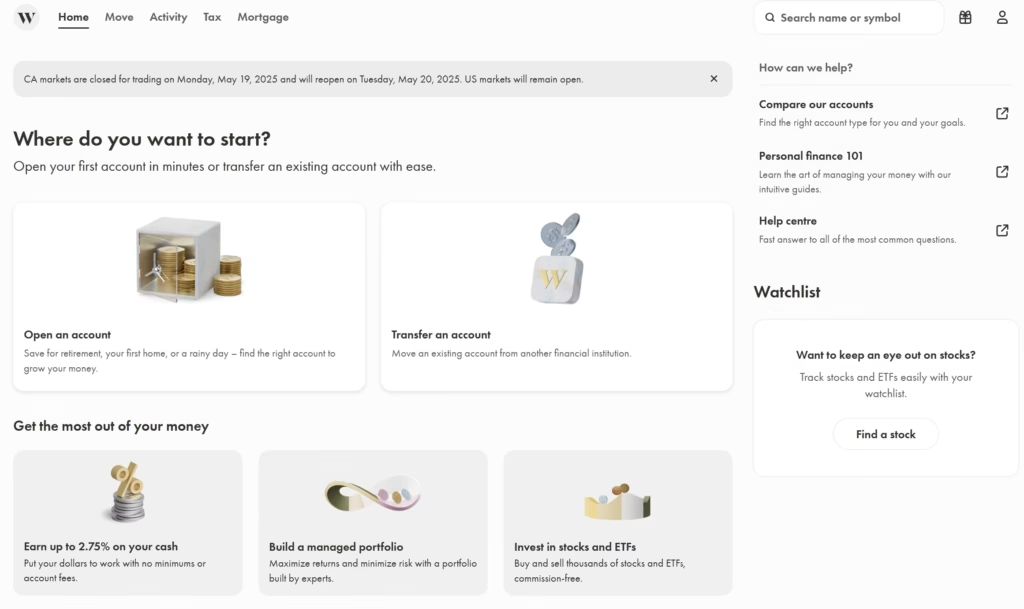

Wealthsimple vs. Moomoo and the Rest: Why Wealthsimple is Canada’s Top Choice for Everyday Investors – And Your Financial Peace of Mind

In recent years, the landscape of retail investing in Canada has shifted from a distant, intimidating mountain to a path many of us now feel empowered to walk. Gone are the days of exclusive, jargon-filled platforms. Today, sleek mobile apps, zero-commission trades, and interfaces that actually make sense are inviting millions of Canadians to take the reins of their financial future. And standing tall at the heart of this revolution, a familiar and trusted friend, is Wealthsimple Trade – a homegrown Canadian favorite that continues to win hearts and minds. While flashy newcomers like Moomoo burst onto the scene with impressive tools for the seasoned trader, it’s Wealthsimple that truly understands the Canadian investor’s journey, offering a blend of trust, simplicity, and robust features that feels like it was made just for us.

I started noticing Moomoo everywhere – those slick YouTube pre-rolls, banner ads that seemed to follow me, whispers on social media, even popping up on my favorite podcasts. Their marketing blitz is undeniably aggressive, and it sparked a genuine curiosity: what’s the big deal with Moomoo? Is it offering something groundbreaking that we Canadians are missing out on? This curiosity sent me down a rabbit hole, researching not just Moomoo but the wider investing landscape. And what I discovered was a profound sense of clarity: for the average Canadian looking to build wealth steadily, securely, and without unnecessary headaches, Wealthsimple isn’t just an option; it’s the hand that guides you, the platform that says, “You can do this.” Its local focus, unwavering support for those all-important registered accounts, and beautifully intuitive design make it a far more comforting and effective partner.

This article is more than just a comparison; it’s an exploration of why Wealthsimple resonates so deeply with Canadians. We’ll delve into what makes it the beloved choice and stack it up against other major players like Moomoo, Questrade, Interactive Brokers, Qtrade, and TD Easy Trade. Our aim? To show you, with heart and head, why Wealthsimple is poised to remain the best platform for most Canadian investors, not just in 2025, but for the journey ahead.

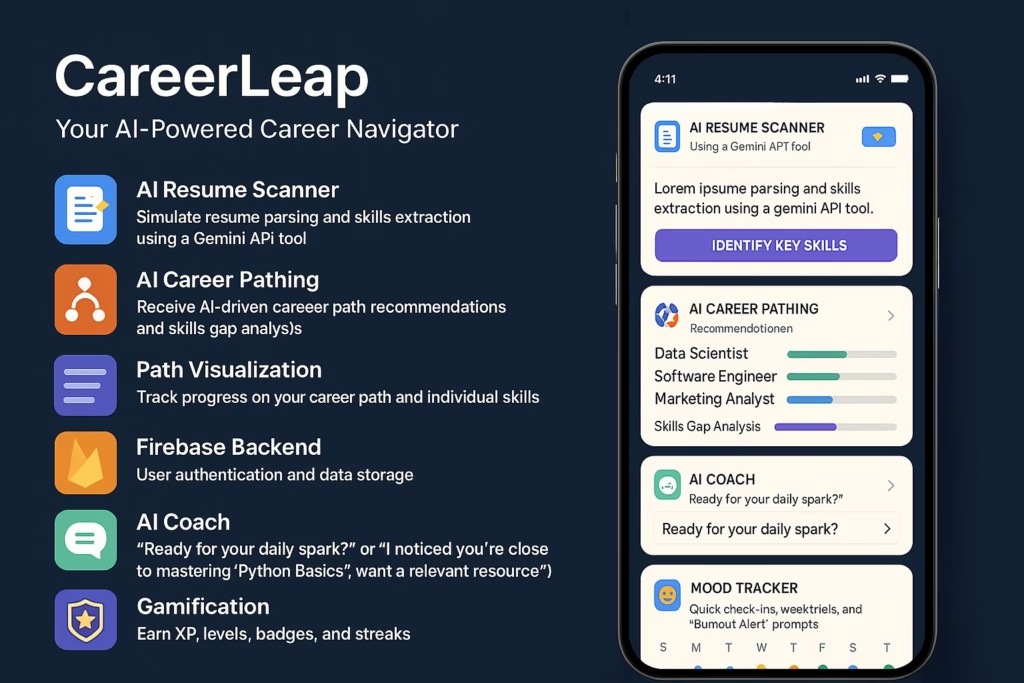

Wealthsimple: The Gold Standard in Canadian Investing Apps – Your Ally in Building Wealth

Wealthsimple Trade hasn’t just appeared; it has earned its place as the go-to platform for a generation of beginner and casual investors across Canada. It was conceived with a simple, powerful idea: investing shouldn’t be scary or complicated. Backed by one of the nation’s most trusted financial technology brands, it offers a refreshing simplicity that doesn’t skimp on the essentials, making you feel capable and in control from your very first tap.

Key Features of Wealthsimple (And Why They Matter to You):

- Commission-Free Trading: Imagine, $0 fees on Canadian and U.S. stock and ETF trades. This isn’t just a feature; it’s freedom. Freedom to invest without that nagging feeling of fees eating into your hard-earned money. Every dollar you invest goes to work for you.

- Registered Accounts (TFSA, RRSP): This is where Wealthsimple truly shines for Canadians. Offering Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP), it supports the very bedrock of Canadian financial planning. These aren’t just account types; they’re vessels for your dreams – a tax-sheltered future, a comfortable retirement.

- No Account Minimum: Start with as little as $1. This isn’t just a low barrier; it’s an open door. It says, “Come as you are, start where you are.” That first dollar invested can be the most empowering step you take.

- Fractional Shares: Ever eyed those big-name U.S. stocks and felt they were out of reach? Fractional shares let you own a piece of your favorite companies, even if you can’t afford a whole share. It’s about participation and ownership, democratized.

- Crypto Integration: Curious about cryptocurrencies? Buy and sell directly in the app you already trust. It’s about exploring new frontiers with a familiar guide.

- Modern, Mobile-First Design: The intuitive UI/UX feels less like a financial tool and more like your favorite app. It’s designed for real life, for quick checks on the go, for making informed decisions without feeling overwhelmed.

- Wealthsimple Plus: An affordable upgrade that feels like a VIP pass, removing pesky FX fees on U.S. trades and unlocking even more useful features.

Drawbacks (And Why They Might Not Be Drawbacks for You):

- Limited Advanced Tools: It’s true, Wealthsimple isn’t built for the hardcore technical trader or the adrenaline-seeking day trader. But for most of us, that’s a blessing. It means clarity over clutter.

- No Options or Margin Trading: These advanced features are absent, which might deter sophisticated users. But for the everyday investor, this focus keeps things beautifully uncomplicated and helps avoid potential pitfalls.

Moomoo: A Powerful Toolkit for the Technical Virtuoso

Moomoo’s arrival in Canada has certainly stirred the pot, and for experienced traders, it’s an exciting prospect. Its platform is a veritable command center, bristling with advanced charting tools, real-time Level 2 market data, and an almost dizzying array of customization options.

Key Features of Moomoo:

- $0 commissions on U.S. stocks and ETFs: A definite plus for frequent U.S. traders.

- Advanced technical analysis: With 63+ indicators and deep market data, it’s a playground for those who speak the language of charts.

- Paper trading: A safe sandbox to test complex strategies before risking real capital.

- Active online community: Connect with millions of users globally, sharing insights and ideas.

Drawbacks (And Why They’re Significant for Most Canadians):

- No TFSA or RRSP account support: This is a deal-breaker for many. Investing outside these tax-sheltered accounts means missing out on crucial tax advantages that are fundamental to long-term wealth building in Canada. It feels like a guest who doesn’t quite understand Canadian customs.

- High FX fees and margin rates: While commissions might be low, other fees can bite, especially for those not actively managing currency conversions.

- Overwhelming interface for beginners: What’s powerful for an expert can be paralyzing for a newcomer. The sheer volume of data and tools can feel like trying to drink from a firehose.

Other Platforms at a Glance: A Quick Tour of the Neighbourhood

- Questrade: A well-established player. Free to buy ETFs is great, and they fully support registered accounts. But that $1,000 account minimum can feel like a hurdle when you’re just starting to dip your toes in.

- Interactive Brokers (IBKR): The undisputed king for global market access and rock-bottom fees if you’re a high-volume trader. However, its complexity is legendary. It’s like being handed the keys to a fighter jet when you’re just learning to drive.

- Qtrade: Known for excellent customer support and solid research tools. But with trading fees around $8.75 and potential account minimums, those costs can add up, especially when you’re building your confidence and portfolio.

- TD Easy Trade: A familiar name, especially if you bank with TD. 50 free trades a year is a nice perk for basic investors. But the tools are limited, and it can feel a bit like a walled garden if your ambitions grow.

Platform Comparison: The Nitty-Gritty

| Feature | Wealthsimple | Moomoo | Questrade | Interactive Brokers | Qtrade | TD Easy Trade |

|---|---|---|---|---|---|---|

| Commission-Free Trades | Yes (CA & US stocks/ETFs) | Yes (U.S. stocks/ETFs) | ETFs only (buy) | No (low fees) | No ($8.75) | 50/year |

| TFSA/RRSP Accounts | Yes | No | Yes | Yes | Yes | Yes |

| FX Fee | 1.5% (0% with Plus) | ~1.5% (varies) | ~1.5%-2% | ~0.002% (min $2) | ~1.5%-1.99% | ~1.5% |

| Min. Deposit | $0 | $0 | $1,000 | $0 | $0 (some fees may apply if below threshold) | $0 |

| Advanced Tools | Basic | Advanced | Moderate | Advanced | Moderate | Basic |

| Mobile App | Excellent | Good | Good | Good | Good | Good |

Why Wealthsimple Doesn’t Just Stand Out, It Welcomes You In

While platforms like Moomoo speak to the technically fluent, and Interactive Brokers opens global doors for the sophisticated trader, Wealthsimple is purpose-built with the Canadian heart in mind. It’s for those of us who value simplicity, dream of tax-sheltered growth, and crave a sense of trust and partnership.

- Accessibility that Feels Like an Invitation: No deposit minimums and a clean, uncluttered interface don’t just make it easy; they make it welcoming. It feels like the investing world has finally opened its doors to everyone, regardless of how much you start with.

- An All-in-One Ecosystem for Your Financial Life: It’s not just about trading stocks. It’s about having a financial co-pilot. Invest in crypto, earn rewards on your cash, automate your long-term portfolios – all within one intuitive space. It’s about simplifying your financial life, not complicating it.

- Deeply Canadian Roots and Support: Based in Toronto and governed by Canadian regulations, Wealthsimple gets us. They understand the nuances of Canadian finance, they speak our language, and their support feels local and responsive.

- A Brand Built on Trust, Not Hype: With over 3 million Canadians using its services and the backing of Power Corporation, Wealthsimple offers a profound sense of security. This isn’t just about your money; it’s about your peace of mind.

Use Case Scenarios: When Wealthsimple Feels Like It Was Made For You

- You’re new to investing, and the old way felt intimidating: You want to tiptoe, not dive headfirst. You want to invest small amounts in a TFSA without being penalized by fees. Wealthsimple holds your hand and says, “It’s okay, let’s start together.”

- Your life is mobile, and your investments should be too: You want the power to check your portfolio, make a trade, or just feel connected to your financial goals, all from the palm of your hand, anytime, anywhere. Wealthsimple’s app feels like a natural extension of your life.

- You crave clarity, not complexity: You don’t need (or want) options trading, margin accounts, or overwhelming analytical dashboards. You want a straightforward path to building wealth. Wealthsimple filters out the noise.

- You dream of one app for your core financial needs: From that first foray into crypto to your long-term stock investments and even managing your spending cash – Wealthsimple’s ecosystem brings it all together with elegance and ease.

Final Thoughts: For Most Canadians, Wealthsimple Isn’t Just a Choice, It’s the Answer

If you’re a Canadian investor – whether you’re taking your first tentative steps or simply seeking a more modern, human-centric, and low-cost way to grow your wealth – Wealthsimple isn’t just leading the pack; it’s clearing the path. It offers a sense of empowerment that’s hard to quantify but easy to feel.

While advanced users with very specific, technical needs might find a temporary home with Moomoo, or navigate the complexities of Questrade or Interactive Brokers, these platforms often come with a steeper learning curve, potential hidden fees, or a disconnect from the core Canadian saving strategies.

Wealthsimple continues to win the hearts of Canadians because it’s:

- Built for you, the beginner and the everyday investor: It speaks your language and anticipates your needs.

- Designed for your Canadian financial journey: Its embrace of TFSA/RRSP is not an afterthought; it’s foundational.

- Committed to innovation that empowers, not overwhelms: It grows with you, without making you feel left behind.

In a financial world that’s constantly evolving, often becoming more complex, Wealthsimple stands as a beacon of accessibility, reliability, and trust. It’s more than just an investing app; it’s an enabler of dreams, a partner in your financial well-being, and for most of us, the most reassuring and intelligent starting point to take control of our money and build the future we envision.

- Stop Preparing for the Google Interview of 2020. Here’s What Changed.

- We Asked 100 Google Engineers How They Use Gemini: Here’s What We Learned

- Why Your Next Promotion Might Depend on Your AI Literacy (Not Your Code)

- From Marketing to Machine Learning: How One Googler Reinvented Their Career

- A Tuesday at Google: Why Our Offices Are Buzzing Again